Thinkorswim (often stylized and officially branded as "thinkorswim", lacking capitalization) is a software product by TD Ameritrade that offers tools and educational services for online investing. It is geared for self-directed stock, options and futures traders. It was previously offered by ThinkorSwim Group, Inc., which was purchased by TD Ameritrade in 2009.

TD Ameritrade provides services for self-directed option traders and institutional users who invest in equities, exchange-traded funds, futures, mutual funds and bonds.

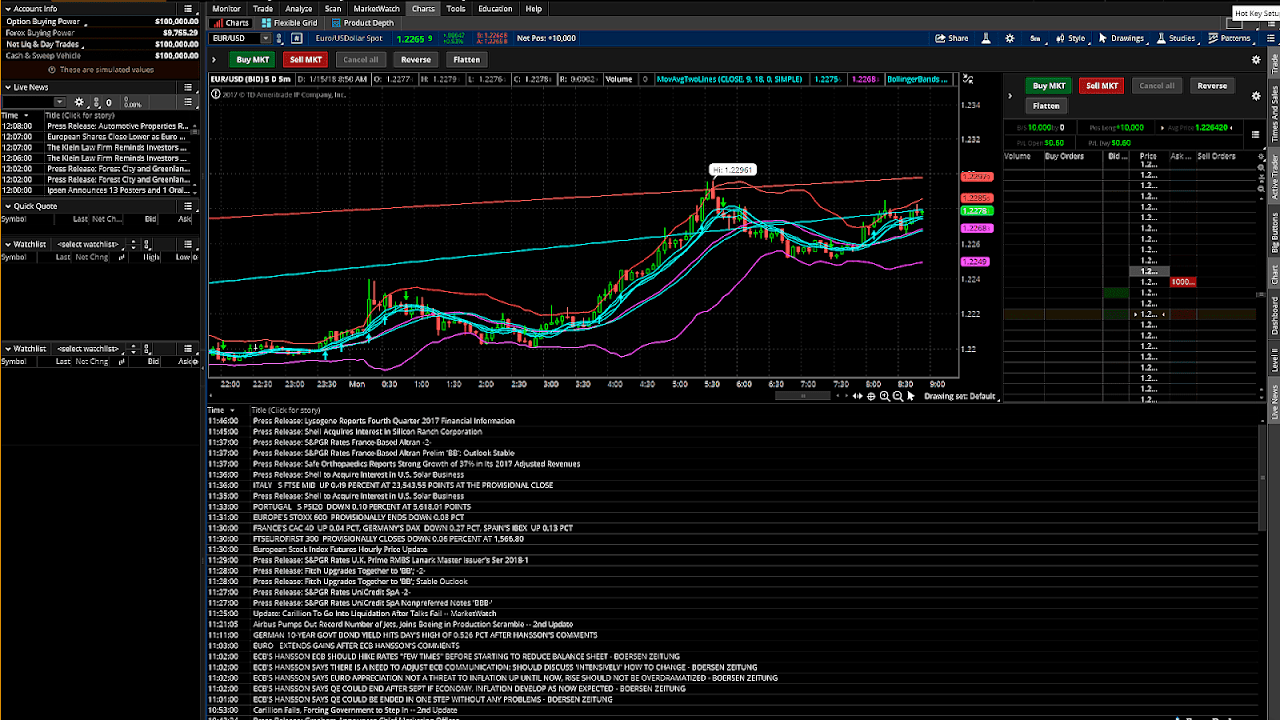

Thinkorswim provides investor education and services for self-directed investors including trading tools and analytics. It offers a range of investor education products in a variety of interactive delivery formats, including instructor-led synchronous and asynchronous online courses, in-person workshops, one-on-one and one-to-many online coaching programs and telephone, live-chat and email support. Thinkorswim is used in conjunction with trades of equity securities, fixed income, index products, options, futures, other derivatives and foreign exchange. The Thinkorswim software is provided free for account holders of TD Ameritrade and trades via the TD Ameritrade platform cost $6.95 each.

Maps, Directions, and Place Reviews

History

Thinkorswim, Inc. was formed through multiple company mergers and acquisitions:

- In 1982, Telescan, a provider of stock charting and screening tools, was founded by Dr. Richard Carlin in Houston, Texas.

- Also in 1997, Online Investors Advantage, an investor education company, was founded.

- In 1999, Thinkorswim, Inc. was founded as an online brokerage specializing in options.

- In 2000, an international investor education company, ZiaSun, acquired Online Investors Advantage.

- in 2000, Lee Barba started as CEO with Telescan.

- On December 6, 2001, ZiaSun merged with Telescan to form Investools.

- In January 2005, Investools purchased Prophet Financial Systems, Inc. and embarked on a re-architecture of the Investor Toolbox. Prophet's founder, Tim Knight, was made the Senior Vice President of Technology. In May, Investools common stock was listed on NASDAQ in May 2006 and added to the Russell 3000, 2000 and Microcap indexes on June 30.

- In January 2006, Thinkorswim acquired Arrowhead Solutions, a privately held, institutional sell-side trade order management system provider.

- In September 2006, Investools announced a merger with Thinkorswim. In February 2007, the company completed the merger with Thinkorswim and its ticker symbol was changed to SWIM. In June 2008, the group adopted the name of its brokerage subsidiary, Thinkorswim, for its corporate identity, changing the listed holding company's name from Investools, Inc. to Thinkorswim Group Inc. New York investment banking firm Paragon Capital Partners, led by David Adler and Michael Levy, initiated this transaction, and acted as INVESTools' financial advisor in connection with the proposed merger and with respect to the financing of this transaction. (link to press release) At the time of the transaction, Thinkorswim had been a portfolio investment of Technology Crossover Ventures. [link to press release]

- Revenue for 2007 was a record $318 million, including the operations of Thinkorswim from February 15, 2007. Client assets were almost $2.6 billion at December 31, 2007.

- In May 2008, the company announced that it was cooperating with an informal U.S. Securities and Exchange Commission investigation into presentations used during sales meetings.

- In January 2009, TD Ameritrade Holdings Inc. acquired Thinkorswim Group Inc. (including its INVESTools division) in a cash and stock deal valued around $606 million.

Td Ameritrade Tools Video

S.E.C. investigation & penalties

On 12/10/2009 the Securities And Exchange commission began an investigation into Investools' (purchased by thinkorswim) use of misleading sales practices in which 2 named defendants Michael J. Drew ("Drew") and Eben D. Miller ("Miller") were giving trading workshops under the guise of being full-time investors by trade, having made their fortunes in this manner as well as assuring students they would achieve the same results by following the Investools method. Among the allegations by the S.E.C. "Investools Did Not Prevent its Speakers from Misleading Investors about a Survey of its Customers' Trading Success"

Source of the article : Wikipedia

EmoticonEmoticon